A novel measure of arbitrage activity, developed by Dr Dong Lou and Professor Christopher Polk to examine whether arbitrageurs can have a destabilizing effect in the stock market, has been featured by investment experts MSCI in their “crowding scorecard” as one of four key metrics for monitoring and detecting the potential crowding risk for any investment strategy.

The original LSE research, ‘Comomentum: Inferring Arbitrage Activity from Return Correlations’, was a Paul Woolley Centre Working Paper in 2013.

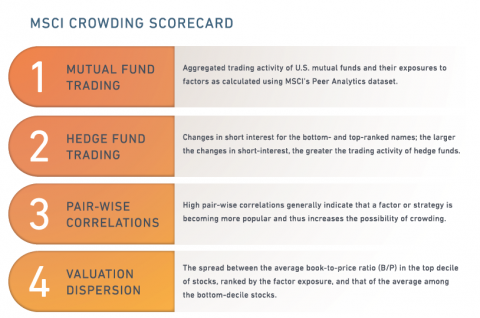

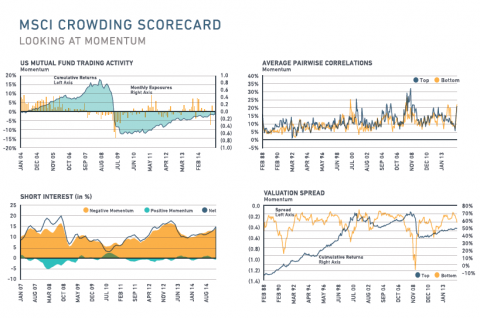

Comomentum is defined as the high-frequency abnormal return correlation among stocks on which a typical momentum strategy would speculate. Independent investment experts MSCI included the measure alongside Mutual Fund Trading Activity, Hedge Fund Trading Activity, and Valuation Dispersion as essential components for monitoring and detecting potential crowding risk.

One of the other MSCI crowding scoreboard measures, Valuation Dispersion, directly follows from Prof. Polk’s 2003 Journal of Finance article, 'The Value Spread', coauthored with Randy Cohen and Tuomo Vuolteenaho, and is also studied in Lou and Polk’s work, including their recent Paul Woolley Centre Working Paper, 'The Booms and Busts of Beta Arbitrage'. That piece takes the ideas in Comomentum, as well as the Value Spread, and applies them to the low-risk anomaly.

See more from MSCI: Lost in the Crowd - how to spot crowded trades